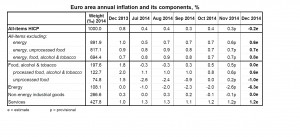

Latest official estimate has shown that the Eurozone inflation is negative 0.2% in December 2014, indicating that it has entered into deflation for the first time in more than five years. The negative figure is mainly driven by a sharp fall in energy prices, -6.3% compared with -2.6% last month, which is mainly caused by the global plunging of oil prices. Prices remain stable for food, alcohol & tobacco, non-energy industrial goods and services. Considering the index without energy prices, the inflation figure remains the same as last month.

The latest figure is seen as a big challenge for the European Central Bank (ECB) as it previously pledged to keep Euro inflation rate close to 2%. Economists are concerned that Eurozone might enter into a deflationary spiral, which would lead to lower production, wages and demand in a vicious circle. Given the high level of debt in Eurozone countries, deflation will also increase the burden for indebted countries.

The market has now a high expectation that, in the next ECB policy vote on 22 Jan, the ECB would take further measures attempting to reverse the deflationary trend of the Eurozone, potentially via quantitative easing (QE), which is the purchase of sovereign bonds with newly created money. However, it is not certain whether the ECB could rally enough support from member countries to support this move. For example, Jens Weidmann of the German Bundesbank has previously made it clear his aversion to QE. According to a commentary by Wolfgang Münchau on Financial Times dated 12 Jan, although the writer does not see QE as a likely outcome in the near future, he warned that if policy-makers do not take decisive actions soon, the Euro may repeat the stagnation scenario that Japan experienced in 1990s.